Tencent and Visa are part of the investors that pooled a total of $8 million for Nigeria’s fintech startup PayStack. Stripe also participated in Series A round, according to a statement by the company.

“The round was led by Stripe, and includes Visa, follow-on funding from Tencent and Y Combinator, as well as angel investors Tom Stafford (Managing Partner at DST Global), Gbenga Oyebode (founding partner of Aluko & Oyebode and Board member of MTN Nigeria), and Dale Mathias (Co-founder, Innovation Partners Africa),” PayStack stated.

This brings Paystack’s total investment to date to more than $10 million.Existing investors include Tencent, Y Combinator, Comcast Ventures Catalyst Fund, Blue Haven Ventures, and Ventures Platform.

Paystack will invest the new round of funding in scaling its engineering team, further deepening its payments infrastructure, and accelerating their expansion across the continent.

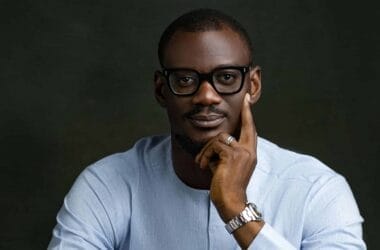

“As recently as 2015, it was really difficult for a developer or business owner in Nigeria to quickly start accepting online payments,” says Shola Akinlade, CEO and co-founder of Paystack. “We started Paystack because we believe that better payments tools are one of the most important things that African businesses need to unlock their explosive potential. We think of Paystack as an amplifier of the incredible work that African business owners are already doing. With better technology tools, African businesses can be better equipped to play a growing role in the global economy.”

“The Paystack founders are highly technical, fanatically customer oriented, and unrelentingly impatient,” says Patrick Collison, CEO of Stripe. “We’re excited to back such people in one of the world’s fastest-growing regions.”

“Africa is central to Visa’s long-term growth strategy, especially when you consider how cash is still a primary payment option for millions on the continent,” says Otto Williams, Head for Strategic Partnerships, Fintechs and Ventures for Visa in Central & Eastern Europe, Middle East and Africa (CEMEA). “Our investment in Paystack aligns with the kind of investments we look for – those that will help extend our reach into the global commerce ecosystem as it changes and grows, and that will provide mutually beneficial business opportunities.”

Akinlade adds: “As Paystack looks to expand rapidly across the continent, we’re thrilled to have the benefit of the deep experience of Stripe, Visa, and Tencent. Our ambition is to give African merchants the tools and services they need to go toe-to-toe with the best businesses in the world, and win.”

As an Amazon Associate, TechCity may earn a small commission if you shop these products.