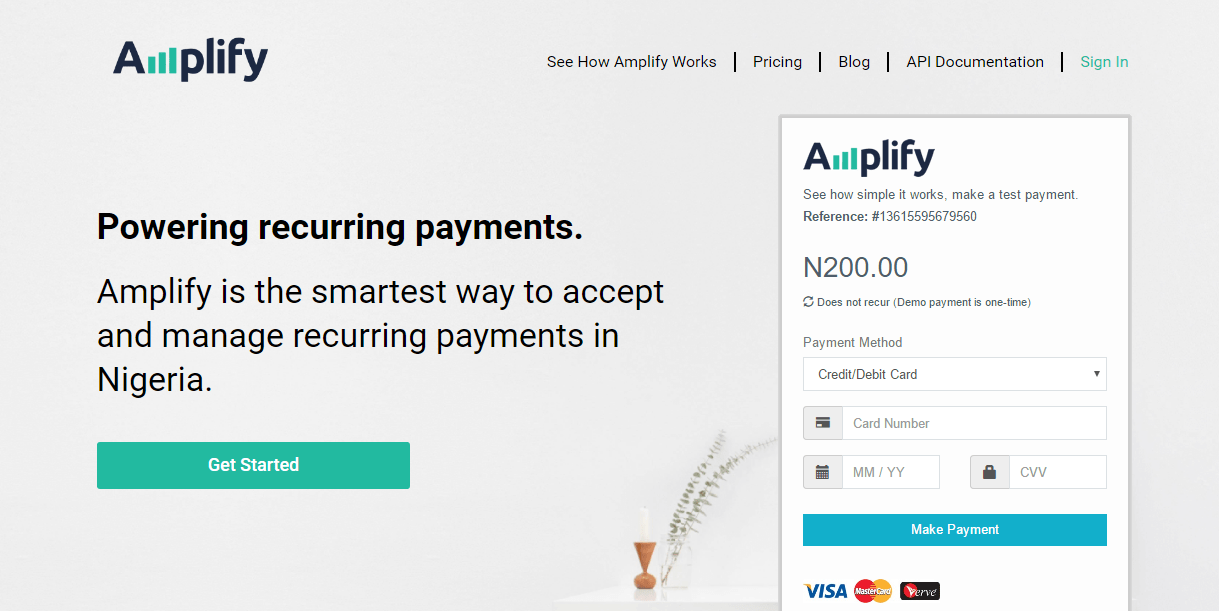

MEST-incubated Nigerian startup Amplify today officially launches to compete in Nigeria’s highly competitive payment space. Unlike SimplePay and others, Amplify is aiming to help Nigerian businesses to accept recurring payments online.

The company isn’t really new as it had name Amplify may be new, but the company isn’t. It spent months testing its services under the name SlushPay.

“Using Amplify, businesses can accept payments within minutes from customers in over 100 countries,” the company said in a statement.

While many may argue that recurrent payment is still unpopular in Nigeria, Segun Adeyemi, CEO of the company argues otherwise.

“Many businesses in Nigeria accept recurring payments, but it is surprisingly difficult to accept and manage these payments, they improvise with methods like post-dated cheques, regular transfers and direct debit mandates,” he said.

According to him, last year, Nigerians paid more than $1.3 billion in automated direct debits alone.

“We built Amplify to make setting up and managing recurring payments simple for subscription businesses, lending companies, insurance companies, and others,” he said.

Essentially, what Amplify does is it provides a suite of tools to help businesses who have a need to accept and manage recurring payments. The startup allows businesses to quickly accept automatic recurring payments from all over the world using Amplify’s payment gateway.

“If there’s a problem with a customer’s transaction, Amplify’s Card Correction Technology will retry for up to 3 days, while informing the parties. This helps reduce involuntary revenue churn,” he added.

Another feature of Amplify is that it allows businesses to discover operational insights such as revenue forecasts and customer loyalty reports. And with the aid of Amplify’s third party gateway integration tool, Adeyemi said businesses can add their existing payment gateways such as Interswitch Webpay or Unified Payments to take advantage of Amplify’s value added services.

“For businesses who need to get setup quickly, Amplify lets them create a simple payment collection form that they can send to customers. And for businesses who’re more comfortable with code, Amplify provides secure and robust Restful APIs that developers will love,” the company’s CEO said.

As an Amazon Associate, TechCity may earn a small commission if you shop these products.