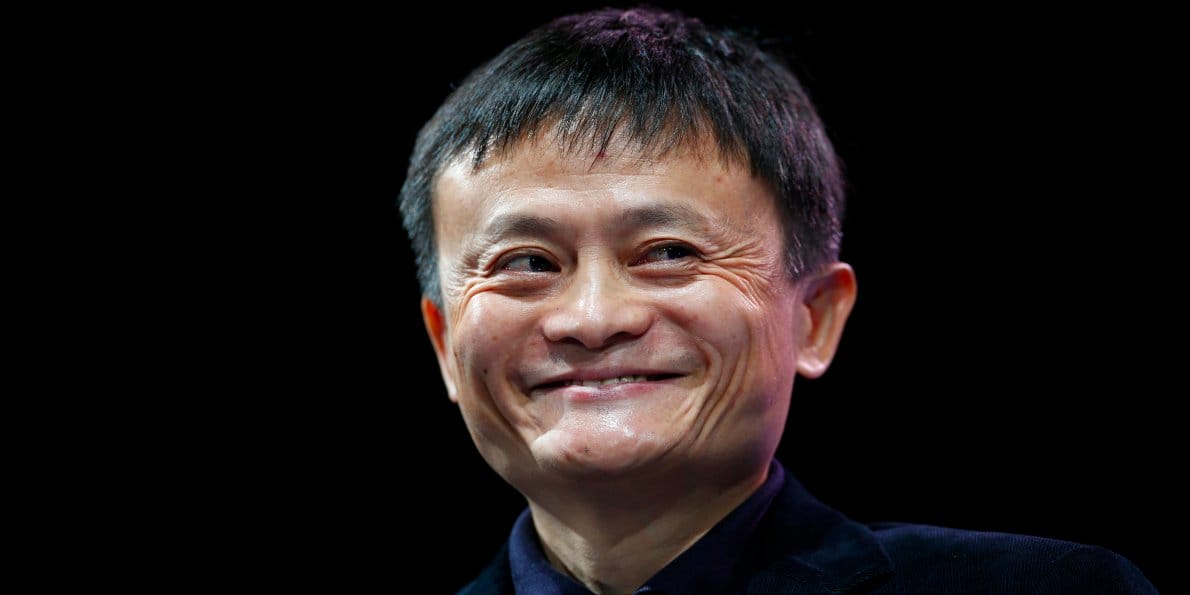

Jack Ma, the founder of Ant Group, has agreed that he will be giving up control of the Chinese fintech giant as part of an overhaul of the company. This move follows the regulatory crackdown that was triggered after Ant’s $37 billion IPO, which would have been the world’s largest, was suspended in November 2020.

While some analysts have said that the relinquishing of control could clear the way for Ant to revive its IPO, the changes announced by the company are likely to result in a further delay due to listing regulations. In China, domestic A-share markets require companies to wait three years after a change in control before they can list, while the wait is two years on Shanghai’s STAR market and one year in Hong Kong.

Ma’s Control

Ma previously controls more than 50% of voting rights at Ant, but the changes will see his share fall to 6.2%, according to Reuters calculations. The billionaire only owns a 10% stake in Ant, an affiliate of e-commerce giant Alibaba Group Holding, but has exercised control over the company through related entities. Hangzhou Yunbo, an investment vehicle for Ma, controlled two other entities that own a combined 50.5% stake in Ant, according to the firm’s IPO prospectus.

The ceding of control by Ma comes as Ant is nearing the completion of its two-year regulatory-driven restructuring, with Chinese authorities expected to impose a fine of more than $1 billion on the company. This penalty is part of Beijing’s sweeping and unprecedented crackdown on China’s technology titans over the past two years, which has resulted in hundreds of billions of dollars being wiped off their values and a reduction in both revenues and profits.

Ant investors can (now) have some timetable for an exit after a long period of uncertainty

Duncan Clark, chairman of investment advisory firm BDA China.

However, Chinese authorities have recently softened their tone on the tech crackdown as they try to boost the $17-trillion economy, which has been badly hit by the COVID-19 pandemic. “At least Ant investors can (now) have some timetable for an exit after a long period of uncertainty,” said Duncan Clark, chairman of investment advisory firm BDA China.

ANT Group

Ant operates China’s mobile payment app Alipay, the world’s largest, which has more than 1 billion users. The company’s businesses also include consumer lending and insurance product distribution. Ant also announced that Ma and nine of its other major shareholders have agreed to vote independently. It also stated that the shareholders’ economic interests in Ant will not change as a result of the adjustments.

Jack Ma is one of China’s most successful and influential businessmen. He founded Alibaba Group, the e-commerce giant, in 1999 and has since become one of the country’s wealthiest men. However, since the cancellation of Ant’s IPO, Ma’s empire has been under regulatory scrutiny and has undergone a restructuring. Ma, who was once outspoken, has largely remained out of the public eye since the cancellation of the IPO.